Pirated content consumption

in Russia

Consumer survey report

Pirated content consumption

in Russia

Consumer survey report

Pirated content consumption

in Russia

Consumer survey report

The online survey spanned eight federal districts and polled 7,500 Russian Internet users aged 18 to 55 who like watching and downloading films and TV series.

7,500

18–55

Age group

Russian Internet users

WILLINGNESS TO USE PAID SERVICES

1

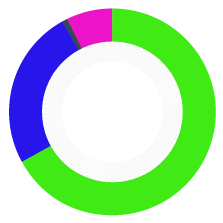

Most Russian Internet users never pay for content, 25% pay occasionally, and only 1% prefer to pay. The attitude toward paid content did not vary across federal districts or depending on the city size.

Pay occasionally

25%

Prefer to pay

1%

Of Russian Internet users never pay for content

67%

Don't watch content online

7%

Do you pay to watch content? (n=7,500)

Younger Internet users pay for content less frequently, with 70% of the 18–24-year-olds opting for free content only. This is much less common for the 45–54 age group, where no-pay is an option for 59% of respondents. Reasons may vary from the younger demographic's more modest income to their greater savvy when it comes to resources offering free content.

PREFERRED PLATFORMS

2

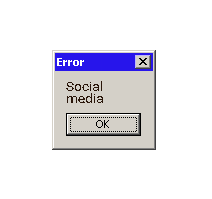

The majority (59%) of users watch content on social networks, making them the most popular platform. Half (49%) of the respondents download content from torrent sites. Almost a third (33%) of those surveyed browse for free content accessible on pirate websites. Only 9% of respondents are subscribed to streaming services and other legal platforms.

9%

What platforms do you use to watch content? (n=7,500)

33%

49%

59%

Consumers across the eight federal districts differ in their choice of platforms for watching/downloading content.

Far Eastern audiences prefer torrent sites (54%) over social networks (50%), while the opposite is true for the Northwestern Federal District, where a lot more people watch content on social media compared to the sample average (67% vs 59%).

Platforms that specialise in providing illegal content – torrent sites – are more popular among men, with women mostly going for social networks.

Far Eastern audiences prefer torrent sites (54%) over social networks (50%), while the opposite is true for the Northwestern Federal District, where a lot more people watch content on social media compared to the sample average (67% vs 59%).

Platforms that specialise in providing illegal content – torrent sites – are more popular among men, with women mostly going for social networks.

MOST POPULAR STREAMING SERVICES

3

Respondents who watch or download content legally were asked which platforms they use.

52% mentioned the Ivi video streaming service. Other platforms were much less prevalent in the responses. Megogo and Okko came as the second and third most mentioned (by 12% and 8%, respectively), while Amediateka, Netflix, and Tvzavr were cited by only 2–4% of the respondents. The remaining few got mentioned by less than 1%.

Those who do not pay for content out of principle were asked about the amount they would be willing to spend on watching films and series. 56% stated $3 as the maximum, while 37% found acceptable the range of $3–8. Only 1% of the audiences are prepared to pay more than $15 a month.

52% mentioned the Ivi video streaming service. Other platforms were much less prevalent in the responses. Megogo and Okko came as the second and third most mentioned (by 12% and 8%, respectively), while Amediateka, Netflix, and Tvzavr were cited by only 2–4% of the respondents. The remaining few got mentioned by less than 1%.

Those who do not pay for content out of principle were asked about the amount they would be willing to spend on watching films and series. 56% stated $3 as the maximum, while 37% found acceptable the range of $3–8. Only 1% of the audiences are prepared to pay more than $15 a month.

The highest monthly price for legally streamed content for 93% of respondents

$8

HOW MUCH ARE YOU WILLING TO PAY MONTHLY FOR ACCESS TO MOVIES AND TV SHOWS? (N=3,580)

Ivi.ru

53%

12%

8%

4%

Megogo.net

Okko.tv

Amediateka.ru

3%

Netflix

2%

TVzavr.ru

<1%

Other platforms

PLATFORMS FOR WATCHING CONTENT FOR FREE

4

Survey participants who watch or download content for free were asked a similar question. The most frequent answers were the Vk.com social network and torrent sites. 10% cited YouTube, and 5% – the Ivi streaming service, the most popular among occasional users of paid content.

Among Russian Internet users who do not pay for content, 19% use a VPN to access websites that are blocked in Russia, with another 25% not needing a VPN because the content they are looking for is available for free on unblocked platforms. Among the 18–24-year-olds, 22% use a VPN, compared to almost 1.5 times fewer users in other age groups.

Among Russian Internet users who do not pay for content, 19% use a VPN to access websites that are blocked in Russia, with another 25% not needing a VPN because the content they are looking for is available for free on unblocked platforms. Among the 18–24-year-olds, 22% use a VPN, compared to almost 1.5 times fewer users in other age groups.

of those who do not pay for content do not know how to use a VPN

57%

YOU SAID YOU USE LEGAL PLATFORMS TO WATCH/DOWNLOAD CONTENT. PLEASE SPECIFY WHICH ONES (N=675)

Vk.com

17%

16%

10%

5%

Torrent sites

YouTube

Ivi.ru

3%

Kinogo

2%

Zona.ru

2%

OK.ru

8%

Other platforms

Designer:

Anna Ilyina